The common thread is providing clarity and deep understanding (insight) through data/connection (nexus) in specific domains like biomechanics, business strategy, or tech infrastructure.

Here's a breakdown of the main entities:

1. Vicon Nexus Insight (Software)

- What it is: A reporting tool for Vicon's motion capture systems, used in life sciences to turn complex movement data into easy-to-understand reports, charts, and graphs.

- Key Use: Biomechanists use it to create comparative reports for research and analysis.

2. Nexus Insight (Consulting/Expert Network)

- Expert Network: A firm connecting businesses with experts, focusing on markets like Southeast Asia and North America for intel, pre-IPO, and M&A.

- Consultancy (Africa): A firm offering strategy, management, and tech advice for business growth, emphasizing data-driven solutions.

- Global Security: An organization focused on global security and intelligence with a localized perspective, providing risk assessments for investments.

3. Cisco Nexus Dashboard Insights (Tech/Data Center)

- What it is: A Cisco solution for data center analytics, providing deep visibility and operational intelligence for modern, AI-ready infrastructures.

In essence, "Insight Nexus" combines "Insight" (understanding, clarity) with "Nexus" (connection, hub, core) to signify platforms or services that bridge data/knowledge with actionable understanding in specialized fields.

To get the right information, you need to know which "Nexus Insight" you're interested in: Vicon (motion capture), the consulting groups (business/security), or Cisco (data centers).

About the Author(s):

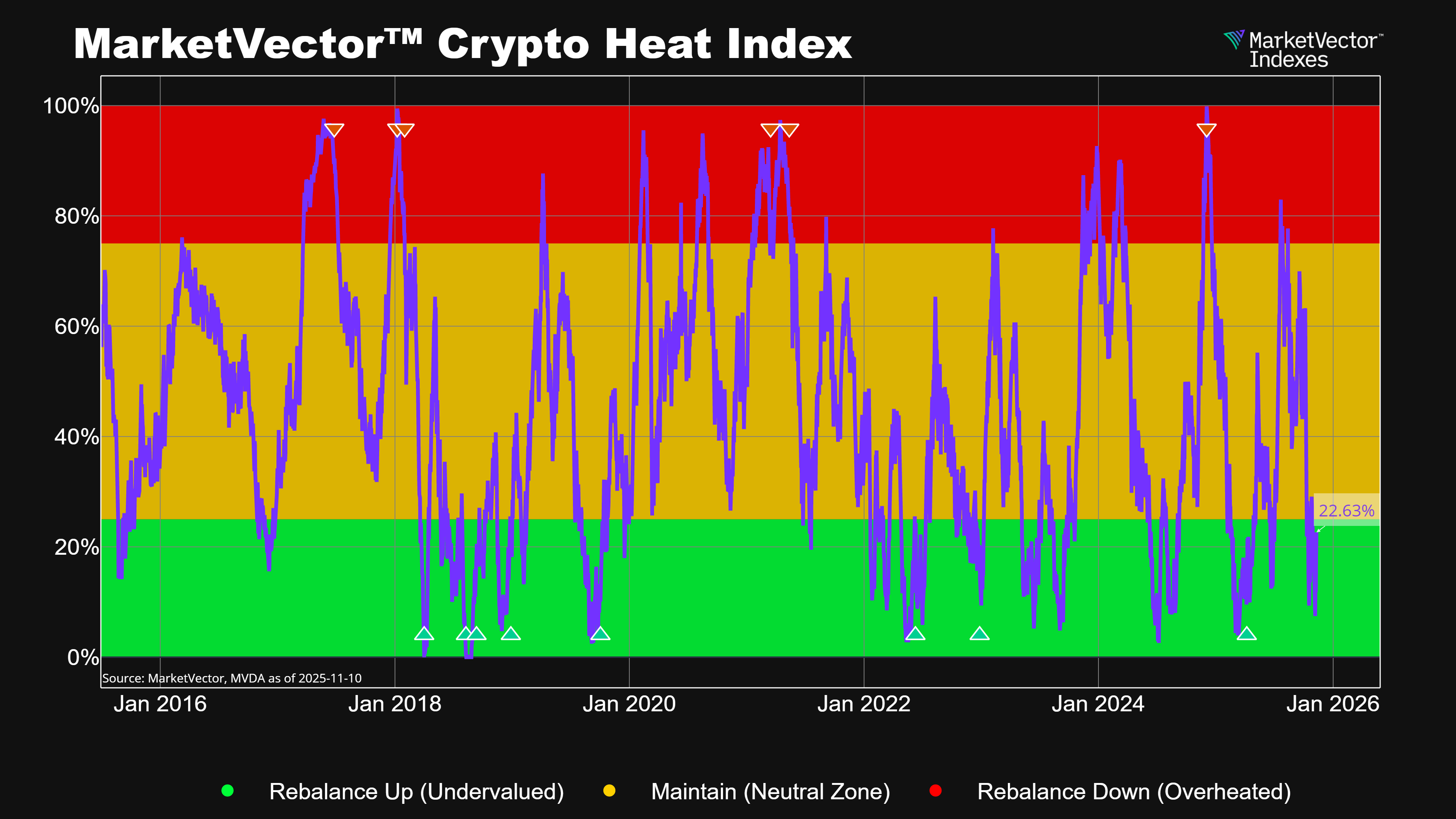

Antonio Fons Palomares is an Index Specialist at MarketVector Indexes™ ("MarketVector"). He is primarily responsible for the research, development, and maintenance of MarketVector Indexes™ across all asset classes. Antonio holds a Master's Degree in Financial Engineering from the Business Administration Institute (IAE) of the University of Poitiers, France, and a Bachelor's Degree in Economics and Business Administration from the University of Paris-Saclay, France. He has cleared the CAIA Level 1 exam.

Steven Schoenfeld became the Chief Executive Officer (CEO) of MarketVector Indexes™ (“MarketVector”) following its acquisition of BlueStar Indexes in August 2020. MarketVector is a leading global index provider with more than USD 40 billion in licensed assets tracking its Equity, Fixed Income, Hard Asset, and Digital Asset indexes. As the CEO, he develops and implements the business strategy for the company and oversees all aspects of MarketVector’s operations, research and product development, client service, sales, and marketing. Steven was the founder and the Chief Investment Officer of BlueStar which maintained a family of indexes for global technology stocks, emerging markets, and Israeli equities and bonds. He is a 39-year veteran of the investment management and financial services industry, having served in senior fiduciary positions at Northern Trust, where he oversaw more than USD 300 billion in quantitatively managed global equity and fixed income portfolios, and at Barclays Global Investors (now Blackrock), where he managed more than USD 70 billion in developed and emerging market stock index fund and ETFs. Previously, Steven led the team at the IFC/World Bank which developed the first investable emerging market indexes and traded Japanese stock index futures on the floor of the Singapore Exchange.

Steven is the co-author of Mastering Crypto Assets (Wiley Finance, 2024), Editor of Active Index Investing (Wiley Finance, 2004), co-author of The Pacific-Rim Futures and Options Markets (McGraw-Hill, 1992), and co-founder of IndexUniverse.com (now ETF.com). He has a Bachelor of Arts in History and Government from Clark University, was a Fulbright Scholar in Economics at the National University of Singapore, and has a Master of Arts from the Johns Hopkins School of Advanced International Studies (SAIS).

Publications:

Mastering Crypto Assets: Investing in Bitcoin, Ethereum and Beyond

by Martin Leinweber, Jörg Willig, Steven A. Schoenfeld, et al. | Jan 24, 2024

Active Index Investing: Maximizing Portfolio Performance and Minimizing Risk Through Global Index Strategies

by Steven A. Schoenfeld | Jul 23, 2004

The Pacific Rim Futures and Options Markets: A Comprehensive, Country-By-Country Reference to the World's Fastest-Growing Financial Markets

by Keith K. H. Park et al. | Feb 1, 1992

Get the latest news & insights from MarketVector

Get the newsletterRelated:

.jfif)