As the global energy landscape evolves, nuclear power is emerging as a critical piece of the clean energy puzzle—and investors are taking notice. While solar and wind have dominated headlines over the past decade, nuclear is quietly making a comeback, driven by a powerful convergence of government policy, geopolitical realities, and technological breakthroughs.

In 2025, that resurgence appears to be accelerating. Institutional interest in nuclear and uranium equities has intensified, as these assets are increasingly viewed not only as a hedge against fossil fuel volatility but also as essential components of a diversified, low-carbon energy strategy.

- Trump’s Support for Nuclear Energy: In May 2025, President Trump signed a series of executive orders aimed at boosting nuclear energy in the U.S. This includes accelerating nuclear reactor licenses, reforming radiation standards, and facilitating the construction of new reactors on federal lands, strengthening the sector’s outlook.

- Low-Carbon Energy Source: Nuclear power is one of the most reliable sources of low-carbon energy. With global emissions reduction targets becoming more pressing, nuclear is being increasingly recognized as essential to achieving net-zero goals.

- Energy Independence: Geopolitical tensions, such as the Russia-Ukraine conflict, have emphasized the importance of energy security. Nuclear energy provides a domestic solution that reduces dependence on foreign fossil fuels.

- Technological Innovation: Small Modular Reactors (SMRs) are becoming a viable option, providing a safer and more cost-effective means of nuclear power generation. These innovations are making nuclear energy more attractive to both governments and investors.

Market Impact: Uranium and Nuclear Stocks Climb

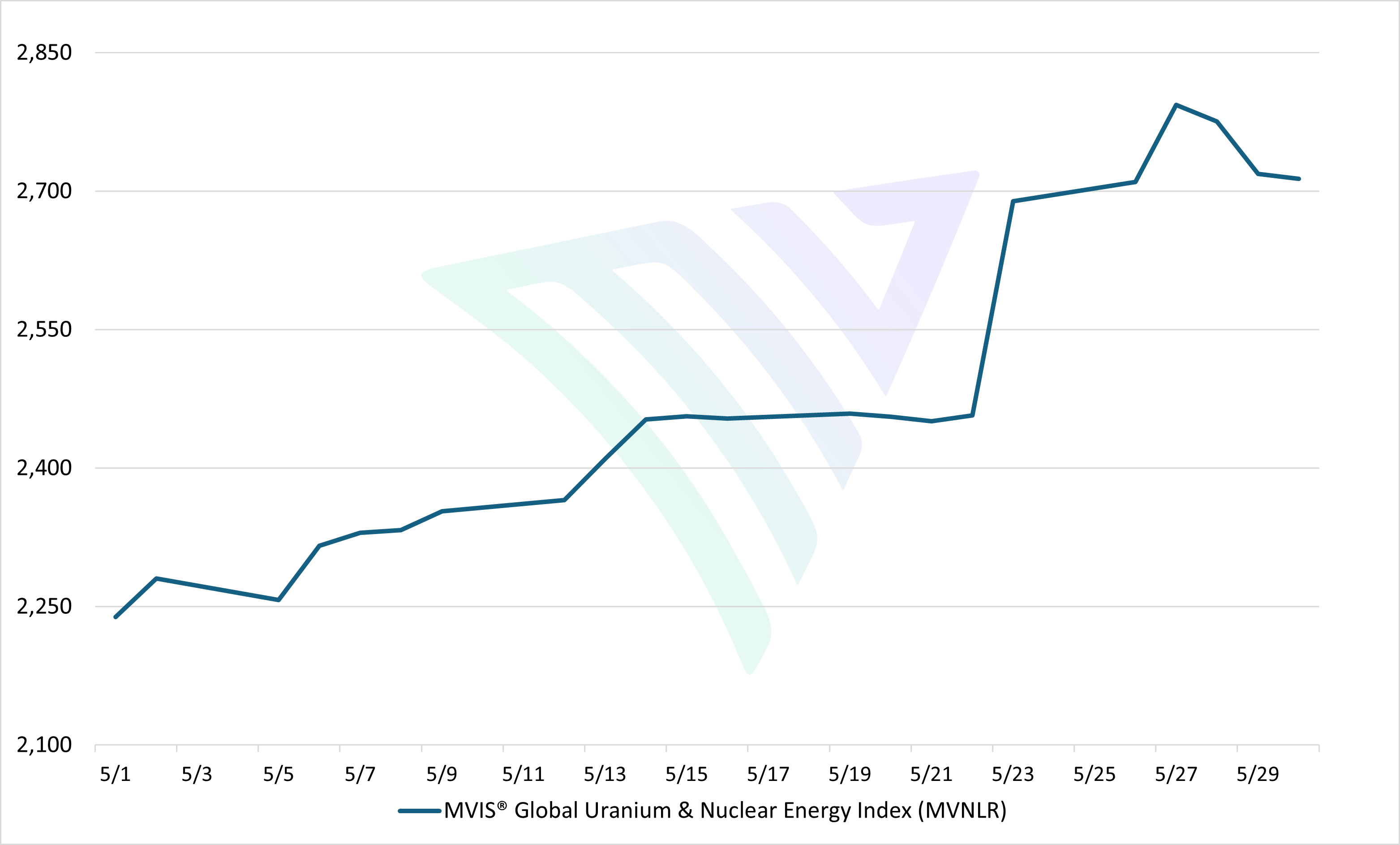

The MarketVector™ Uranium + Nuclear Energy Index (MVNLR)—which tracks the performance of the largest and most liquid companies in the global uranium and nuclear energy industries—was up almost 25% over the past month. This outsized performance reflects a growing consensus: nuclear power is no longer a sidelined sector but a strategic asset class in a carbon-constrained world.

Conclusion: A New Era for Nuclear Investment

For institutional investors, the message is clear: nuclear energy is entering a new phase of relevance. Backed by favorable policy, advancing technology, and a compelling ESG narrative, the sector offers both stability and growth potential in an increasingly volatile energy market.

With the MVNLR index signaling strong momentum, now may be the time to re-evaluate nuclear exposure within energy, infrastructure, or thematic ESG allocations. As the world powers up for a clean energy future, nuclear is poised to play a leading role—and investors who move early may benefit most.

Sources:

- https://world-nuclear-news.org/articles/trump-sets-out-aim-to-quadruple-us-nuclear-capacity

- https://www.iaea.org/bulletin/what-is-net-zero-what-is-the-role-of-nuclear-power-and-innovations

- https://www.eiir.eu/strategic-affairs/energy-security/europes-energy-security-after-the-russia-ukraine-war-a-call-for-pragmatic-action/

- https://www.reuters.com/business/energy/us-approves-bigger-nuclear-reactor-design-nuscale-document-says-2025-05-29/

About the Author(s):

Get the latest news & insights from MarketVector

Get the newsletterRelated: