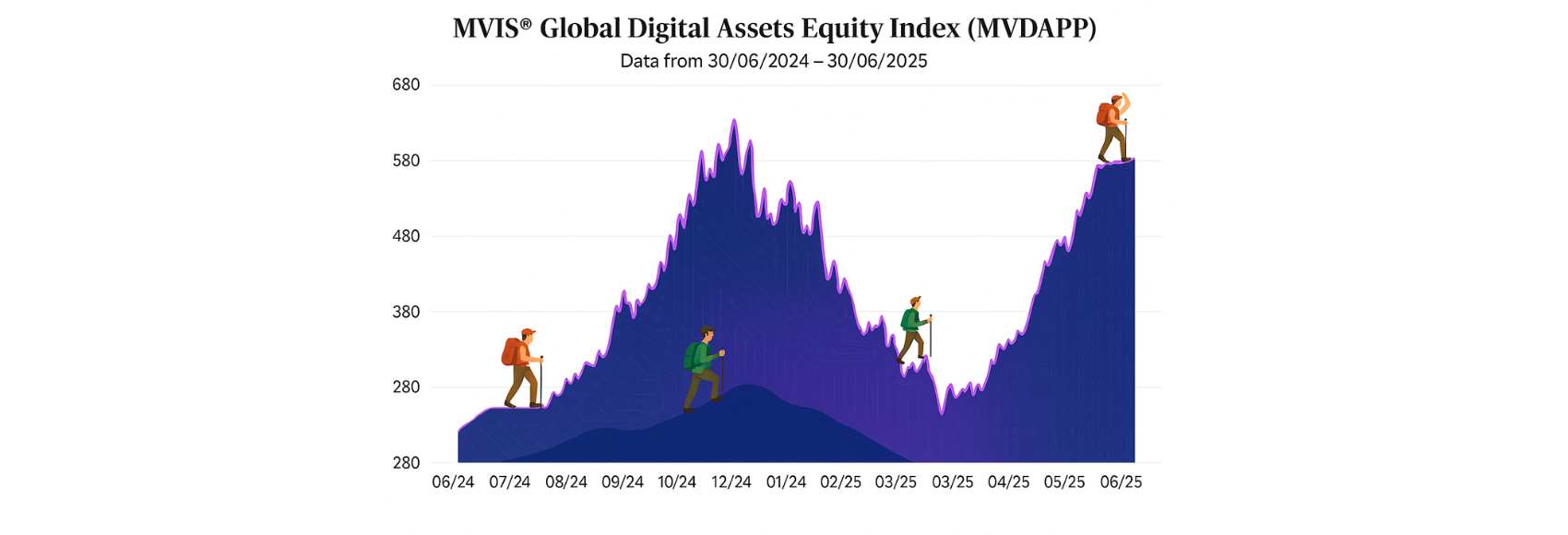

At the center of the evolving financial landscape is the nexus between TradFi and DeFi. MarketVector is proud to be shaping that convergence through our high-performing indexes. The MVIS® Global Digital Assets Equity Index (MVDAPP) stands out wotj +30% performance in May 2025 as a powerful benchmark for the companies leading this transformation, earning it our Index of the Month spotlight.

MVDAPP tracks the performance of globally listed companies deriving at least 50% of their revenues from digital asset services, infrastructure, and blockchain technologies. It offers investors regulated access to the equity side of crypto’s growth story, blending the institutional rigour of traditional finance with the disruptive innovation of decentralized networks.

Top Performers Powering Growth:

Metaplanet Inc soared over +380% YTD, signaling strong market enthusiasm for institutional crypto adoption in Japan.

Circle Internet Group, the company behind the USDC stablecoin, delivered +131% YTD returns amid its anticipated public debut and growing stablecoin usage.

OSL Group, a regulated digital asset platform in Hong Kong, surged +93% YTD, reflecting Asia’s accelerating institutional crypto infrastructure.

Coinbase (+35% YTD) also contributed, fueled by increased trading volume and broader acceptance of digital assets.

By capturing the equity opportunity in digital assets, MVDAPP is a natural choice for forward-looking investors. It reflects MarketVector’s core mission: delivering institutional-grade benchmarks that connect the innovation of DeFi with the trust of TradFi through transparent, rules-based indexing.

Exhibit: MVDAPP 1 Year Performance

Source: MarketVector. Data as of June 30, 2025.

For more information on MarketVector, visit www.marketvector.com

Get the latest news & insights from MarketVector

Get the newsletterRelated: