The 2024 year began with significant growth in AI and semiconductor-related investments, setting the tone for technological innovation. The MVIS® US Listed Semiconductor 25 Index (MVSMH), a flagship thematic MarketVector index, reached an all-time high in 2024 with ~50% YoY returns.

Gold experienced a surge, driven by heightened geopolitical tensions, reaffirming its role as a safe-haven asset. Gold prices rose by approximately 27% YoY, marking the most significant annual gain since 2010.

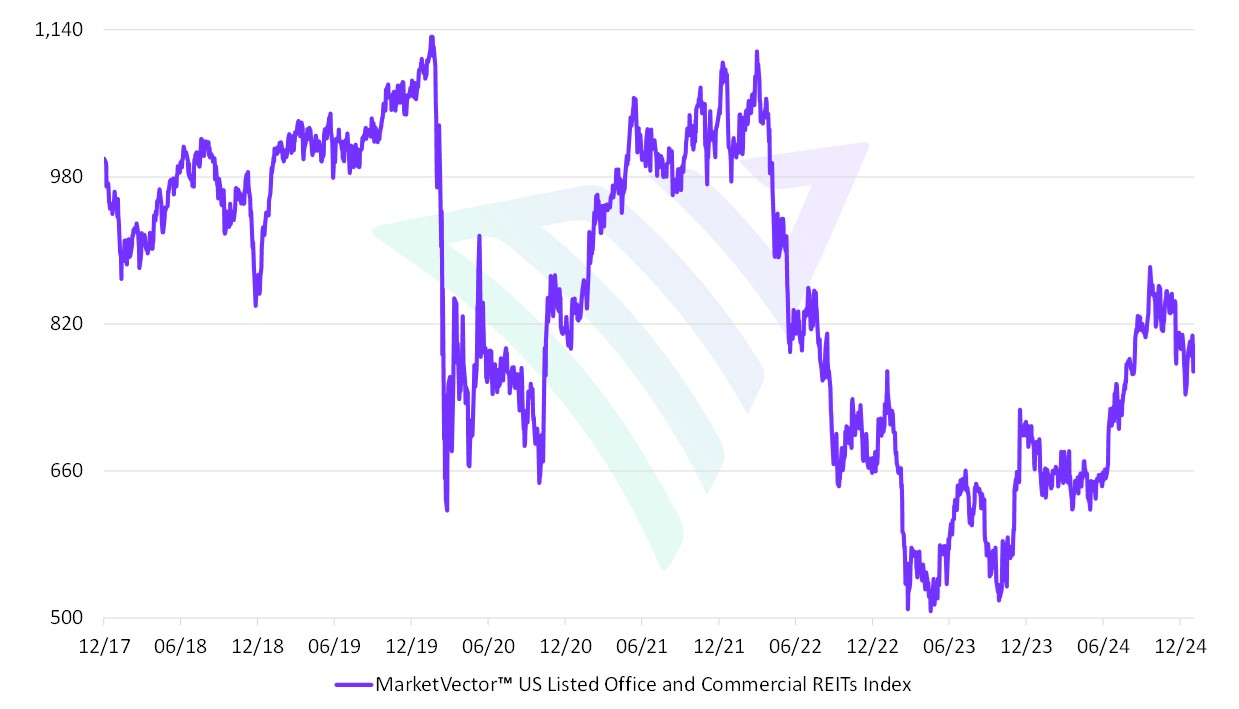

Monetary Easing Fuels Real Estate and REIT Momentum

Midway through the year, the Federal Reserve's shift toward a monetary easing cycle created a favorable environment for real estate investments and REITs. The MarketVectorTM US Listed Office and Commercial REITs Index (MVORT), which tracks US-listed RIETs in office and commercial real estate sectors, was up ~11% in YoY returns.

Source: MarketVector. Data as of January 30, 2025.

Global and Domestic Markets: Robust Growth in Key Sectors

The BlueStar® Israel Domestic Exposure Index (IDEI), a country index that focuses on Israeli companies that generate the majority of their revenue within Israel, showed a path to recovery and was up 33% in 2024.

Defense as a sector witnessed colossal growth. The MarketVector™ Global Defense Industry Index (MVDEF), which tracks global companies involved in national defense sectors, was up almost 33% in YoY.

In Q3 2024, China's economy experienced a significant rebound, driven by a combination of targeted fiscal policies, infrastructure investments, and measures to stimulate domestic demand. The growth provided much-needed relief after a period of subdued economic activity since COVID.

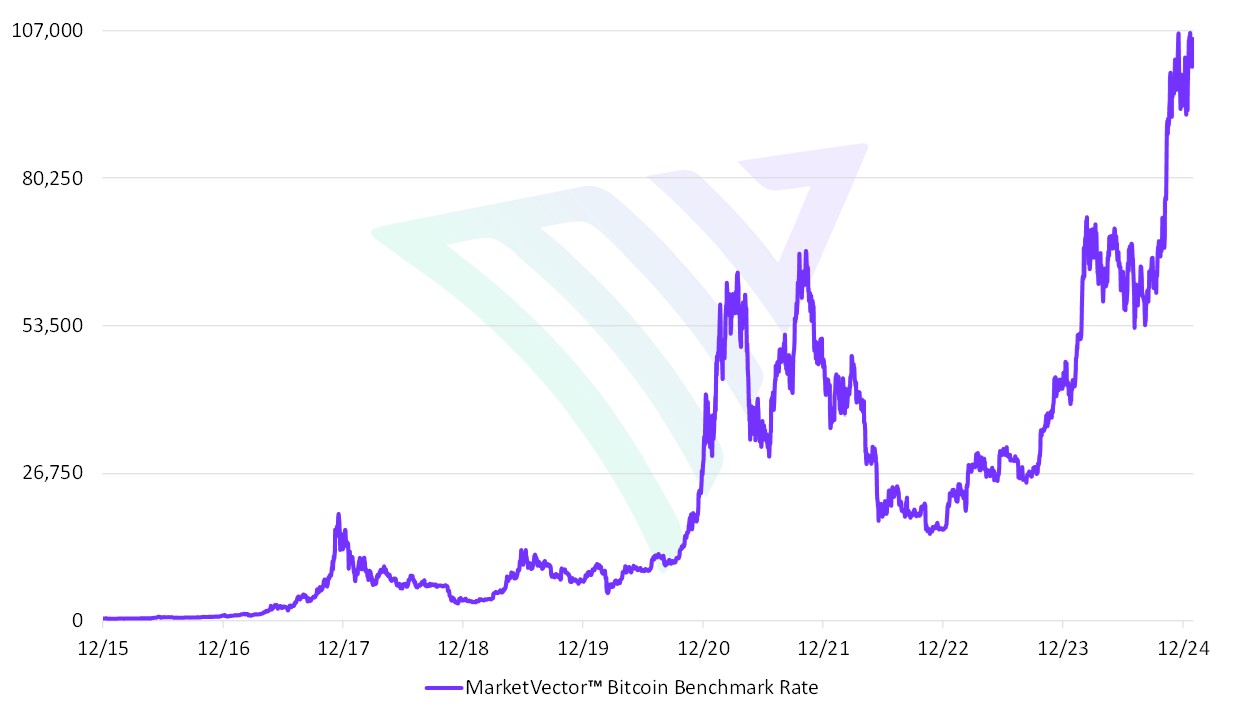

Closing out the year: Bitcoin, S&P, and the Quantum Leap

From early Q4 onwards, both the equities and cryptocurrency markets gained momentum, further catalyzed by the outcome of the U.S. presidential election. S&P 500 reported a consecutive second year of gain of around ~27% in 2024.

Bitcoin reached an all-time high of USD106k in December 2024 with the cryptocurrency ecosystem expanding to more blockchain applications in DeFI and Web3. The MarketVectorTM Bitcoin Benchmark Rate (BBR) went up a whopping 122% in 2024.

Source: MarketVector. Data as of January 30, 2025.

Towards the end of the year, the quantum sector saw growth driven by computing advancements, and hardware & chip sophistication along its application development. The BlueStar® Machine Learning and Quantum Computing Index (BQTUM), which tracks the global quantum computing and machine learning industries was up by ~59% in 2024.

Looking Ahead: Macro Themes Shaping 2025’s Investment Landscape

Overall, 2024 presented good investment opportunities across asset classes and sectors. The diverse performance underscored the importance of a well-diversified portfolio, with various avenues for growth and resilience in an evolving financial landscape.

Entering 2025, we will continue to monitor macro themes like the Fed's interest rate cycle, China's path to recovery, post-U.S. election Presidential policy, and the ongoing geo-political developments along with the various asset classes, and sector/sub-sector opportunities.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: